Restaurants

Restaurants run the risk, of receiving customer complaints about food preparation, spoilage, allergic reactions and sanitation. Train employees the best you can for safety and

Restaurants run the risk, of receiving customer complaints about food preparation, spoilage, allergic reactions and sanitation. Train employees the best you can for safety and

Hair Salon Insurance Hair salon owners know that the services you provide entail some level of risk.. These risks may not seem significant, but a

As the owner of a bakery shop, you can enjoy running your business as long as you pay attention to your potential risks. You are

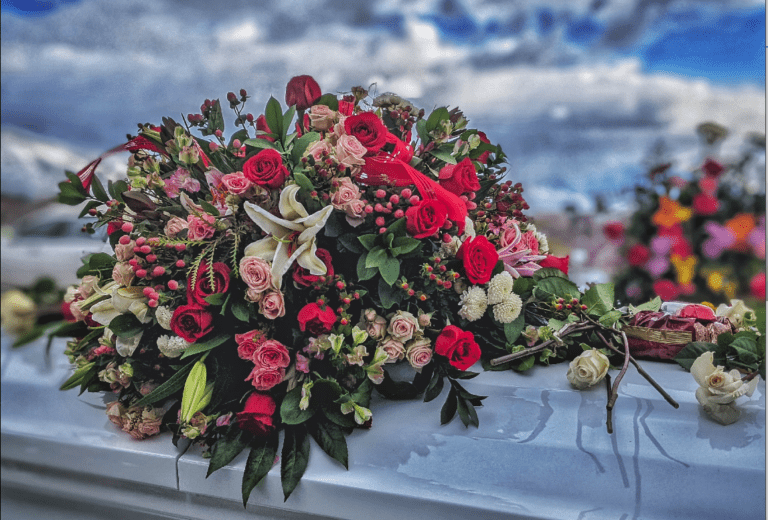

Floral shops that are open to the public present special risks. Customers may walk in unexpectedly or make appointments to discuss special events. Conditions such

Pizzerias run the risk, as with other food establishments, of receiving customer complaints about food preparation, spoilage, allergic reactions and sanitation. Train employees the best

Bagel shops run the risk, as with other sandwich shops, of receiving customer complaints about food preparation, spoilage, allergic reactions and sanitation. Train employees the

General liability and Commercial property are two of the most common types of Funeral Home insurance coverage. General liability is designed to cover the costs

Stationery stores can be very quiet like libraries, or create a hub of activity throughout the day. The design of your store and business model

Owning a liquor store presents it’s own unique risks for you, the business owner, due to the potentially dangerous nature of alcohol. A liquor

Owning a hardware store can be very rewarding, particularly if you enjoy helping people with the equipment, supplies and tools they need to complete a

Barber Shop Insurance It is important to have good barber shop insurance in place to protect the owner, the employees, and the assets of the

Craft Store Insurance Owning an art and craft supplies store can be very rewarding, particularly if you enjoy doing arts and crafts projects yourself. As

Commercial Property Insurance Your grocery store may contain air conditioning and heating systems, cooking and baking equipment, refrigeration units and processing equipment. The right coverage

As a licensed personal fitness trainer, you may be required to carry insurance in order to maintain your license. Personal trainer insurance requirements vary from

You work hard to keep your clients’ skin healthy, clear, and glowing. As people continue to come to you for guidance, it’s more important than

General Liability Insurance. This insurance covers your business against claims for bodily injury and property damage. When adding property coverage to a General Liability policy

There are many types of insurance coverages available, but these policies are the most relevant to auto parts stores. General Liability Insurance Auto parts stores

Running a shoe store business has its own set of unique challenges and rewards. Too many business owners are hit with unwelcome surprises because they

As an owner of a commercial laundry business, you face unique risks when it comes to running a successful establishment. Understanding what your biggest risks

Nail salon and nail technician insurance is customized to fit the needs of nail salon owners and nail techs. Choosing the appropriate coverages for your

If you own and operate an auto repair shop, you most likely know that you’re open to more than a fair share of risks. These

You want your medical office to be the best it can be in the medical profession. Whether you are a doctor, dentist, chiropractor, optometrist, acupuncturist,

Deli’s run the risk, as with other food establishments, of receiving customer complaints about food production or preparation, spoilage, allergic reactions and sanitation. Train employees

Running a dry cleaning business can be a great way to make a living. You don’t have the hassle of worrying about significant inventory—but you

Based on its size and a variety of other factors, there are certain accounting insurance policies that most should consider mandatory parts of their accounting

Just like libraries, book and magazine stores can be very quiet or create a hub of activity throughout the day. The design of your store

Running a fabric business has its own set of challenges and rewards. Too many business owners are hit with unwelcome surprises because they simply forgot

Whether you own a boutique showcasing the very latest runway trends or a thrift store with vintage threads, you put time, money, and effort into

This policy picks up where your auto liability, general liability or other liability coverage stops. With most accidents that occur, your standard policies will provide

Serving the unique needs of businesses One of the most common types of business insurance, commercial property insurance provides a wide range of coverage for

Regardless of the size of your business or what industry you are in, even a small mistake can turn into a very costly lawsuit. What

Insurance companies offer commercial policies that combine protection from all major property and liability risks in one package called a Business Owners Policy (BOP). Created for small

Is your business properly insured? You deserves a business insurance policy that fits your specific coverage requirements. You’ve worked hard to build your business and establish your reputation – make sure you have the coverage that provides peace of mind.

There are two main types of commercial insurance:

Property and Casualty insurance:

The information you provide is kept strictly confidential. A friendly agent will respond to your request and provide the information needed in order for you to make an informed decision. You can also email us at [email protected], call, or text us at 1-833-657-3639

Property insurance provides coverage for stolen, damaged, or destroyed property. Within this are several lines of coverage.

Liability insurance provides coverage primarily for the negligent acts or omissions of the individual, business, or organization. There are several lines of coverage within this category as well:

o Commercial Umbrella –

o Worker’s Compensation –

The Princeton Insurance Agency, Inc. Has been serving the needs of small business owners, individuals and families since 2002.

We would love to hear from you.

Feel free to reach out using the below details.